Yes, setup is time-consuming and detail-heavy. But isn’t the same true of your manual payroll processing?

Ask 10 small business people which element of their accounting tasks they’d like to shed, and chances are that eight of them would say “QuickBooks payroll.” Paying employees is difficult not only because it requires so much precision, but also because you have to deal — accurately — with multiple taxing agencies, including the IRS. QuickBooks Payroll options solve multiple problems, as well as enhancing your understanding of the whole process. They can help you:

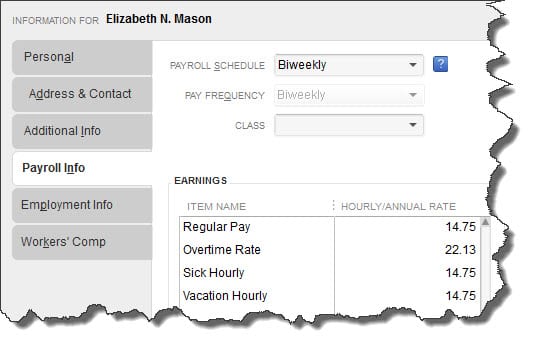

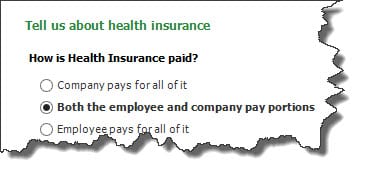

Track and administer company benefits and Workers’ Compensation Insurance. You know that generous benefits can both attract potential hires and contribute to overall job satisfaction. Administering them, though, can be very complicated. QuickBooks’ Payroll Setup tool uses a simple wizard to walk you through the process of entering all of the details required to define them, withhold pay where necessary, and keep up with payments to outside agencies. Employees get thorough pay stubs that spell out contributions made toward:

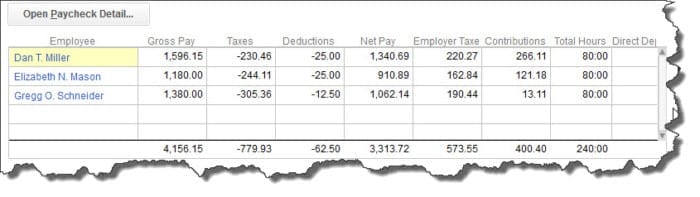

Figure 2: It’s not always this simple, but sometimes it is. Because you laid a solid foundation during the setup process, all of the calculations are done for you by QuickBooks.

There really are no downsides to using one of the QuickBooks’ payroll options. Granted, entering all of your company’s payroll information is a detail-heavy process — and it’s imperative that you get it right, or you’ll have unhappy employees, taxing agencies and plan providers, and probably some penalties to pay. QuickBooks provides good tools, but we strongly encourage you to call us in when you’re getting set up with your new payroll tools. Get it right from the start, and you’ll be able to enjoy payday instead of dreading it.