Hi everyone! Today, I would like to address a great question from a reader who is in the property management business. Carol sent in this question:

I am a property manager and I invoice my landlord using QuickBooks Enterprise. My question is, how do I accept payment and mark the invoice as paid, but apply that payment as a deduction out of the rent that is due to the landlord?

As a landlord, hiring a great property manager can make or break your business. Finding the perfect person for the job accounts for half of the journey towards the profitable endeavor of becoming a landlord. From advertising the property, collecting rent to handling, maintenance and repair issues, an awesome property manager will deliver you from suffering all the headaches and hassles that come with leasing out your property. A great property manager is perfectly capable of taking care of all the things that take the fun out of being a landlord.

As a property manager, aside from providing the best services in these aspects to the landlord and the tenants, one of your most important duties is making payments to the landlords. Ensure that prompt and correct payments are made to the landlord’s foster trust. It builds a great partnership that will create a continuous revenue stream for years to come.

Just like in the situation of Carol, being the middleman between tenants and landlords can put you in a confusing situation when it comes to bookkeeping. Using QuickBooks contributes to better bookkeeping since it allows property managers to easily keep track of all transactions, especially when invoicing landlord’s and tenants.

Before discussing how to make and track payments to owners using QuickBooks, be sure that the following are on-hand for quick reference:

Property Management Agreement

A property management agreement is a contract between the property owner and the property manager. It is a written agreement that clearly outlines the responsibilities of both parties and the terms of the relationship. Putting everything into writing and not relying solely on verbal agreements will lay down clear rules and avoid confusion in the course of the partnership. One of the most important aspects of the agreement is the calculation of the proceeds that will go to the owner. Other important information in the agreement includes:

Tenant Lease Agreement

A tenant lease agreement is a contract between the property owner and tenant of the property. It outlines the rules and responsibilities that will govern the relationship between the two parties. The most basic points that the agreement should cover include

To address the issue on how the payments to the owners should be made, these documents should first be consulted. One of QuickBooks’ great features is allowing the attachment of scanned copies to the transaction records. That way, you do not have to sort through a lot of paperwork every time you need to refer to them. You can easily access and view these documents in QuickBooks.

Quick disclaimer, though. The solution that I will present to Carol’s dilemma may or may not work on your QuickBooks file since the implementation, process and procedure may be different. However, the same concept can be applied to QuickBooks Pro, Premier, Enterprise and Online versions.

First and foremost, you need to refer to the property management agreement between you, the property manager, and the owner. You may invoice the owner and deduct the amount from the owner’s proceeds by following the example given below:

For example, the monthly rent collected for the current month is $1,300. The property management fees are set at 10% of the rental income. Property repairs amounting to $300 were also introduced to the property. We may refer to the Property Management Agreement to ascertain the amount of the management fee. The Tenant Lease Agreement will also show the rent that is due for the month as well as determine if the repairs will be charged to the tenant or the landlord.

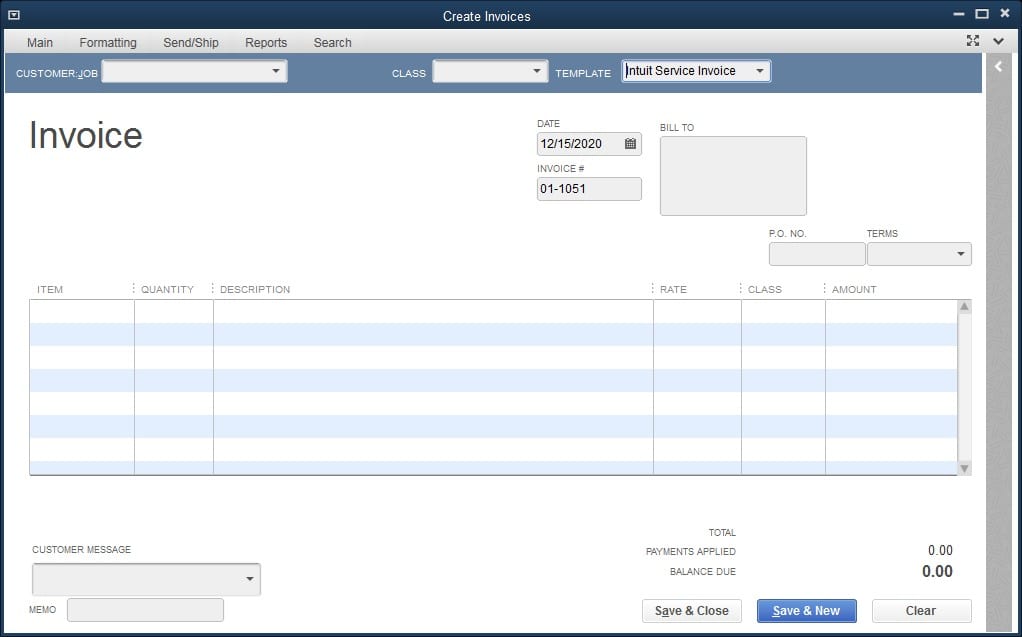

The first thing to do is to create an invoice for the management fee and the property repairs. Based on the example, these are both chargeable to the property owner. To do this, go to Customers >Create Invoices. Enter all the relevant details in the Create Invoices module.

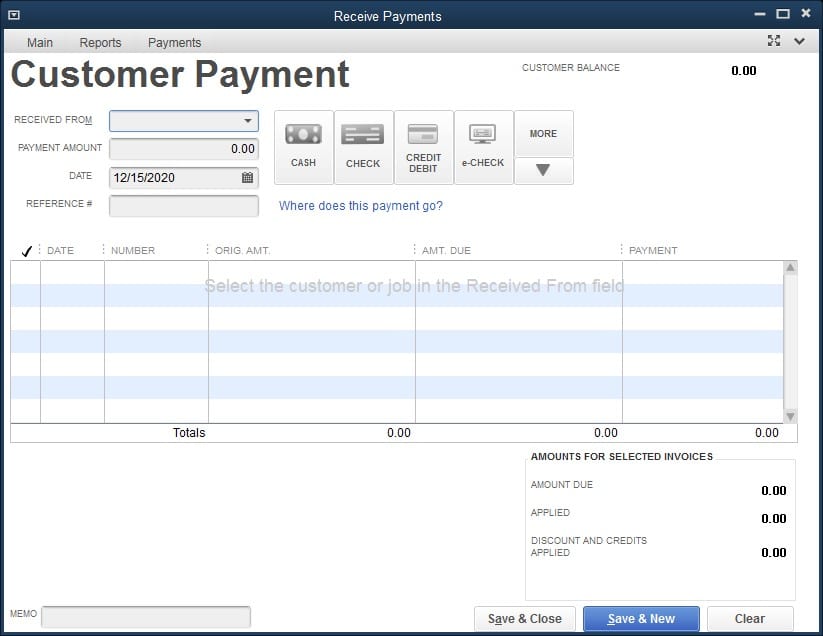

Then, enter the payment received by going to Customers > Receive Payments. Enter all the relevant details. This will mark the invoice as paid.

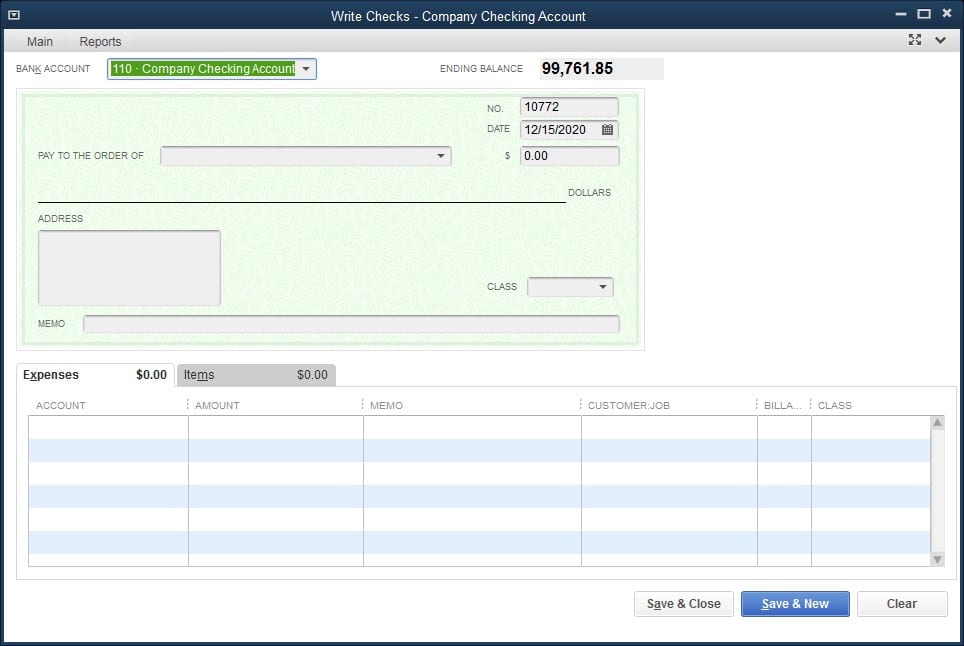

To make the payment to the property owner, you need to write a check for the difference by going to the Write Checks – Checking module.

As I have always said QuickBooks is the one stop software for property management and financial management. Thus making it a breeze to create owners statements in a few seconds.

It is that simple and easy! QuickBooks is a very powerful tool for all your bookkeeping needs in your property management business. If you have any other questions about it or need any form of assistance with your bookkeeping, you may leave a comment below. I will be glad to help you out!