If you are like some of our clients, you may be scratching your head and asking a question similar to the one below.

Q: I am a property manager for several properties. I am setting up the lessees and lessors. Do I enter them in QuickBooks as customers or as both customers and vendors?

A: The lessee and lessor sign a contractual agreement in which the lessee (tenant) agrees to pay the lessor (property owner) for the rental of an asset, in this case, a rental property. Often, the lessor agrees to provide maintenance to the property. In the event that the property owner does not want to actively manage the property, a third party manager will assume the responsibilities for a fee.

If you are a landlord and own all of the properties, you do not need to enter your name as a customer, class, and vendor. Simply, enter your properties as Customers in QuickBooks.

If you are a property manager, you provide property management services to the lessor or the property owner. In this case, enter the property owner as a Customer, a Class, and a Vendor.

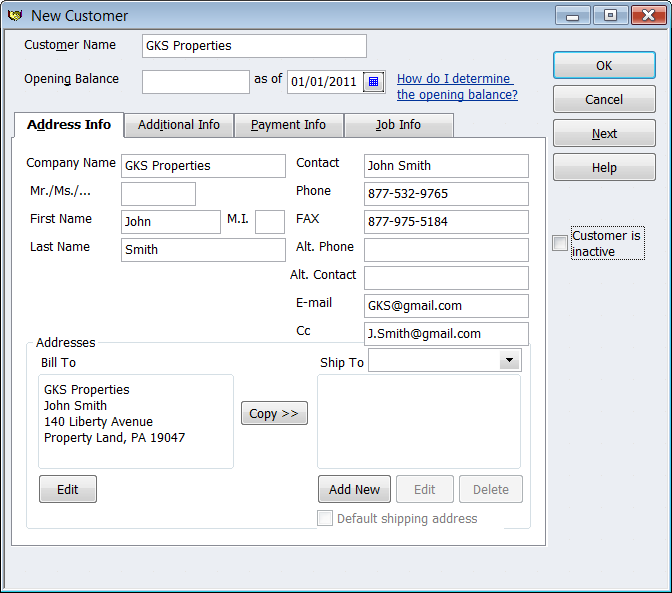

You enter the property owner as a Customer, since as a property manager, the owner is your customer. You are providing him or her with your management services. This will also create a hierarchy and help you organize tenants.

Be sure you enter all of his or her contact information. While QuickBooks is a financial software, you can effectively use it as a property management tool if you enter all of the data. If the shipping address is different from the billing address, make sure you enter both addresses.

Enter the property owner as a Class for tracking purposes. As you incur expenses for properties, you will want to know how much was received and spent per owner for each property. To enter a new class, open the Lists menu and select Class List. Right-click and select New. Enter the property owner’s name.

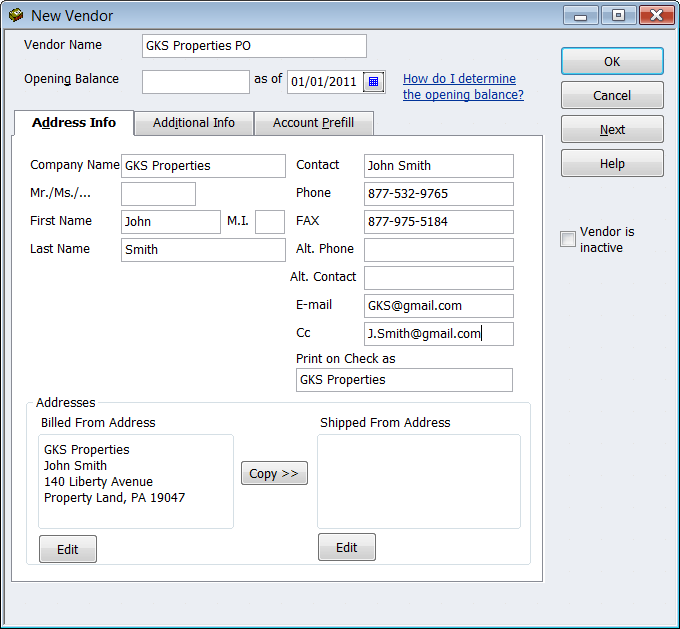

Lastly, enter the property owner as a vendor to simplify the transferal of the rental income to the property owner and track owner’s proceed. Additionally, having property owners enter in your QuickBooks file as vendors allows you to easily calculate 1099s when tax time comes.

To enter a property owner as a vendor, open the Vendor Center and create a new vendor. QuickBooks does not allow a Customer and Vendor to have the same name. Distinguish the Vendor property owner name from the Customer property owner name. In the screenshot below, I added an “PO” to indicate that the property owner is a vendor. Do what works best for you. Be sure that you indicate how the property owner’s name should appear on a printed check in the Print on Check as field.

Entering property owners is the first step to setting up your QuickBooks file for property management. Next, add the properties you will be managing.

[/wpsharely]