QuickBooks comes with numerous reports but how are they useful if we don’t know how to read them? The Profit & Loss statement is a basic accounting statement along with the Balance Sheet, and Statement of Cash Flows.

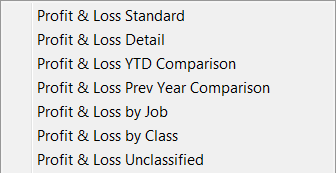

QuickBooks includes the listed Profit & Loss reports. What is a Profit & Loss Statement again? Those of you who have taken accounting class may be a bit rusty on terminology.

The Profit & Loss Statement summarizes your income and expenses so you can determine if you are operating at a profit or a loss. It is also known as an Income Statement. This is an extremely important report to understanding where you business stands!

In QuickBooks, the Profit & Loss Standard is a basic Profit & Loss Statement summarizing the totals of each account. The variations will provide the same information in different ways depending on your needs.

The Profit & Loss Detail report shows year-to-date transactions for each income and expense account. You can double-click on each transaction to open/view.

The Profit & Loss YTD Comparison report summarizes your income and expenses for this month and compares them to the income and expenses of the fiscal year to date. This report lets you know how you’re doing this month in relation to other months.

The Profit & Loss Prev Year Comparison report compares your income and expenses for this month to those of the same month last year. Maybe your business flourishes during December due to the holiday season. Compare the income and expenses from this December to those of last December.

The Profit & Loss by Job report shows how much you are making or losing on each job. If you are using our method to track tenants for property management, this report could show your profit or loss for each tenant.

The Profit & Loss by Class report shows how much you are making or losing within each segment of your business. If you are using our method to track properties for property management, this report could show your profit or loss for each property. The Profit & Loss Unclassified report shows how much you are making or losing from the transactions which are not assigned a Class.