Ever missed a payroll while you were on the road? You only need to experience that once before realizing that in today’s mobile world you must be able to pay employees and contractors from anywhere.

Intuit Online Payroll lets you do just that.

Simplifying a complex setup process

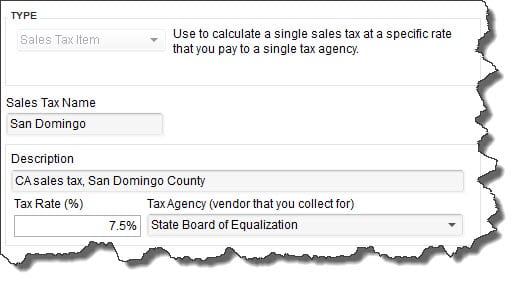

Payroll setup is a time-consuming, detail-laden operation. Intuit Online Payroll makes that as easy as possible with its step-by-step data entry guide.

Assemble all of the necessary information before you start. You’ll simply fill in fields and select options, starting with payroll basics (pay schedules, vacation/sick/PTO, deductions/contributions) and tax information. Once you’ve built that critical base, you can add employees.

Figure 1: You can create a thorough profile for all employees in Intuit Online Payroll.

This information must be correct, or payroll and taxes won’t be accurate. We can help ensure that you’re compliant.

CLICK HERE TO VIEW THE DEMO and TEST DRIVE

State tax filings additional

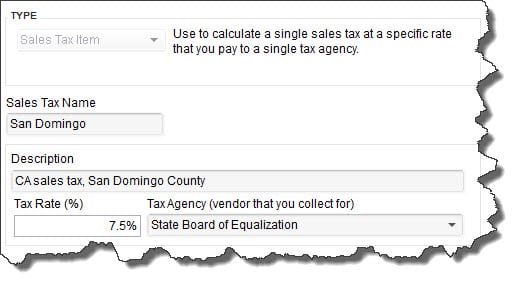

Payroll runs should only take a few minutes. You enter the number of hours worked and type (regular, OT, sick, etc.), approve the amounts, and dispatch payments. Annual forms like W-2s can also be generated.

Payroll Basic includes federal payroll tax filings, payments to employees, check creation and direct deposit, and free support. Payroll Plus offers all of that plus state payroll tax filings. There’s a 30-day free trial. Follow this link to read more about Intuit Payroll.

Even if you only have your smartphone with you, you can still process payroll and synchronize it with Online Payroll using free apps for iPhone and Android devices.

Figure 2: Before you approve paychecks, you can review and edit them.

Taxes, reports, add-ons

Intuit Online Payroll calculates your tax obligations and sends an email reminder when filings are due; you can e-file in many cases or print and mail. The site’s numerous reports are customizable by date, and can be exported to Excel. And add-ons provide specialized services. They include:

Intuit Online Time Tracking

Pay-As-You-Go Workers’ Compensation

Intuit 401(k)

Intuit Health Debit Card

Whether you use this payroll site as a standalone application or integrate with desktop QuickBooks or QuickBooks Online, you’ll save much time and frustration. The accurate tax filings it produces will help prevent onerous IRS penalties.

You’ll eventually move your accounting tasks into the cloud, anyway. Why not now? If you have questions or need help, call us.