Don’t Yet Have a Merchant Account through Intuit? Here’s What You’re Missing

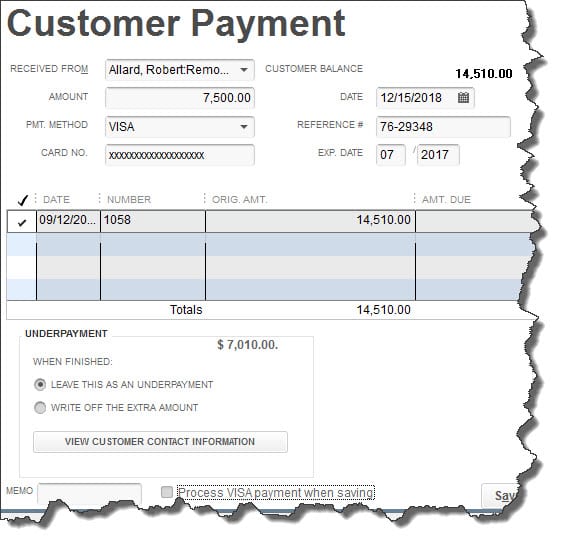

You undoubtedly know people who have stopped carrying cash and checkbooks. So much business is transacted today using credit and debit cards that paper money and check are on their way to becoming endangered species.

If your business doesn’t yet accept credit or debit cards, you can be sure you’re losing sales. A merchant account can contribute to your company’s success in a number of ways. For example, it can:

Going the way of the dinosaur? Not yet. But your business should definitely accept credit and debit cards.

Credit cards are convenient for both you and your customers, but you can expect a learning curve when you start to accept them. You’ll need to learn how to record payments and deal with things like the Intuit Merchant Service Center, chargebacks, and service fees. We can walk you through signup, implementation, and the early stages until you’re comfortable working on your own.

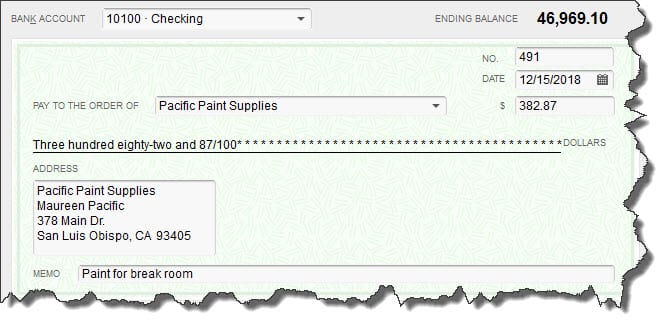

Bookkeeping can be much easier – and funds can move faster – when you accept credit card payments in QuickBooks. But they must be recorded thoroughly and accurately, and you’ll need to make sure that the box in front of Process [VISA, Mastercard, etc.] payment when saving is checked.

The relationship between your merchant account and your QuickBooks files varies depending on the way you’re receiving payments. You may have to move some funds over manually, and it’s critical that you do this right. As always, we’re available to help with this process, and with any other QuickBooks questions you might have. Dealing with a new merchant account is one of the trickier procedures you’ll encounter, but we think you’ll find that the benefits outweigh any temporary need for assistance.