If you’re in charge of your company’s payroll processing, December can be the best of times and the worst of times. While you’re likely looking forward to holiday gatherings and family get-togethers, you’re probably feeling pressure to make sure your payroll files are pristine, ready for year-end forms and for 2014’s data.

If you follow QuickBooks Payroll’s best practices, you’ll be able to greet the New Year with one less set of worries. Consider taking these suggestions:

Order the supplies you’ll need. QuickBooks tax forms for the 2013 tax year are available now.

Budget a block of time for your payroll duties. Yes, QuickBooks Payroll makes your compensation and tax requirements much easier than going through these steps manually. Still, anytime you have to verify information and print special forms, you know well that things can go awry. So schedule a session (or two or three) to take care of this responsibility. Do a test run. Leave yourself time to investigate anything that raises suspicion.

A thorough evaluation of your 2013 payroll situation can help prevent expensive errors.

Make sure that you’ve downloaded the latest Payroll Update. Intuit suggests that you do this before every payroll run or at least every 45 days. The easiest way to ensure that you’re always current is to set up automatic payroll updates. Open the Help menu and select Update QuickBooks. Click the Options tab in the window that opens and check to see that Yes is selected by Automatic Updates. Then put a check mark in front of the desired options.

Verify employee information. Have you entered absolutely all changes that should have been made to employee records this year? It’s also critical that you’re classifying contractors correctly. They’re considered vendors, not employees. Now’s a good time to check on their status.

Make any changes necessary to employee benefits. It’s a good idea to go through your benefits setup and ensure that any changes set to be active in 2014 will be incorporated by then.

Deal with year-end sick and vacation time issues. What you do here will depend on your company’s individual policies. But be prepared to roll over hours, prepare checks for unused time, or whatever else you might do.

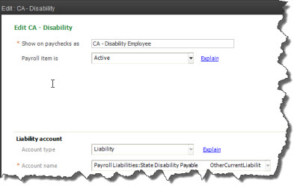

Manually update your SUI or SDI rate. QuickBooks does not include state unemployment insurance or state disability insurance rates in its tax tables, since these are assigned individually by each state. This can be a confusing – though critical – element of payroll setup. If you’re not absolutely clear on how to handle this, please contact us.

Figure 1: To verify that you’ve assigned the correct SUI or SDI rates, go to Payroll Setup in the Employees menu.

Verify your contact and billing information for QuickBooks Payroll. If you have not opted for auto-renew and your subscription is set to expire at the end of this year or the beginning of next, be sure that your name, address and credit card information is current to avoid a disruption of your payroll service at a critical time. (Employees | My Payroll Service | Account/Billing Information)

Run the Payroll Summary and Payroll Liability Balances reports to double-check this year’s work. If you do this now, you of course won’t have the entire year’s data. But you can check to make sure you’re current with your payroll tax liabilities and that you haven’t made payroll errors. If you’re not sure how to analyze these reports, we’ll be happy to help.

You know what that week between Christmas and New Year’s can be like at your company. People are out for vacation, and things tend to run a little slower. Get a jump on your year-end payroll tasks now so you can reach people if you have questions.