Who doesn’t want to improve their cash flow? There are many ways to do this, including more persistent collection methods, timely invoicing, and the occasional sale. If you have a merchant account through QuickBooks, you’ve probably found that that helps, too: If your customers can pull out the plastic to take care of a bill, some of them will be more likely to settle up fast.

But what if at least part of your business is done on the road, at places like trade shows, craft fairs, and business conferences? You’ve probably lost sales because you couldn’t accept a credit card .

Intuit has solved that problem, elegantly and economically, with its GoPayment solution. All you need is a supported mobile device, a small card reader (free), and the app (also free). You can apply here.

The GoPayment card reader attaches to your mobile device.

An Inexpensive Tool

You’ll have to supply the mobile device, but there are no setup or monthly fees. Credit cards supported include Visa, MasterCard, Discover, American Express, Diners Club, and JCB. You can also accept signature debit cards.

There’s no contract, so no cancellation fee. Credit card fees apply, though; they’re usually 2.7 percent of the transaction (manual entry costs roughly 3.7 percent).

If you do a lot of electronic credit card transactions, you can pay $12.95/month to get the rate down to 1.7 percent.

Easy Operations

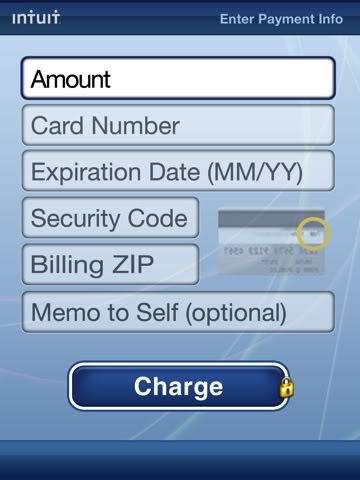

GoPayment gives you a manual data entry option.

Entering a transaction manually is as easy as it is with a desktop-based merchant account. Fill in the blanks and press Charge, and your transaction will be transmitted (for a higher fee).

Swiping the card will save you time and money. The fields on your device screen will be automatically populated with the credit card data grabbed by the reader. Press Charge, and your transaction will be authorized (or not), with the money moving into the bank account you specified (can take 2-3 days). You can also send a receipt to the customer by email or text.

GoPayment gives you an acknowledgement and an authorization ID when a charge goes through.

Your GoPayment data can be viewed on a password-protected website, or it can be downloaded to QuickBooks.

Flexible and Secure

GoPayment supports several of the most popular mobile devices, including:

For a complete list, go to the Intuit GoPayment site.

Intuit secures your data using the same strict standards employed in online banking. Users on your account have their own unique user names and passwords (your company can have up to 50 users). And Intuit offers live phone support 24/7.

While there seems to be an app for everything, some are actually useful. GoPayment is one of these. It solves a mobile sales problem in a smart, simple way, and provides an innovative solution to part of your cash flow problems. IF you have questions of about this service, or want to see if it will work for your business, call us and we’ll discuss it with you.