Running a business in the real estate industry can be an extremely profitable venture, but inaccurate financials can put all of it at risk. That is why it is extremely important to ensure that you record all transactions and data correctly in QuickBooks. Maintaining error-free statements keeps you up-to-date on your business’s position at all times, and it also helps you make the right decisions to increase your profits.

QuickBooks can easily become second nature if you use it regularly, but it can be difficult to keep track of how to do everything, especially in industries like real estate that have particular accounting nuances. One of our clients asked how to create rent items, and you can see what we said below.

Q: I have a small vacation rental property that I manage using QuickBooks. I need some guidance about how to handle items. Should I create an Item List of the individual rental units?

A: In QuickBooks, an item is anything that your company buys, sells, or resells in the course of doing business. Items handle the behind-the-scenes accounting and are one of the keys to filling out forms quickly since they can be used to prefill a description or a rate. To make matters simpler, you can categorize items as services you provide or purchase. In this case, the item would be rent.

By linking an account to each item, you cause QuickBooks to automatically post to the appropriate accounts. You can learn more about creating a custom real estate chart of accounts here.

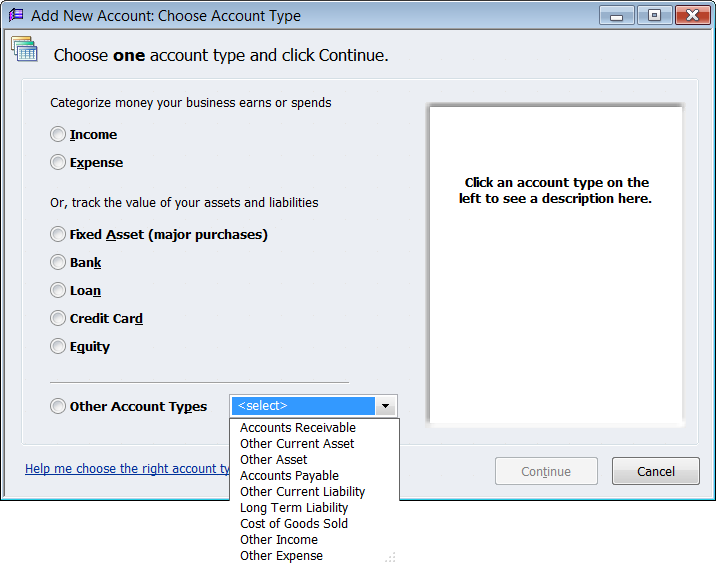

Create a rent item and link it to an income account (preferably called “Rental Income”) by following the steps below:

The following window should appear.

Once you have completed setup for this item, simply select Rent as the item when you invoice tenants or guests. The rent received will then automatically post to the Rental Income account.

For more help with your finances, check out our DIY courses written specifically for real estate professionals. If you’re not too keen on playing it solo, contact one of our team members to take advantage of the accounting services we offer and how they will benefit your business.