There’s no reason to add 20 minutes to your day just by depositing checks payments. Intuit has an electronic solution for you.

Check? What’s a check? You’ve probably heard people say that. The popularity of online bill-pay and credit or debit cards has led to the demise of many paper checkbooks.

But a lot of your customers may still be using them, and that means multiple trips to the bank every week to deposit them. If you wait until you have several, your deposits will be delayed and your cash flow will slow down.

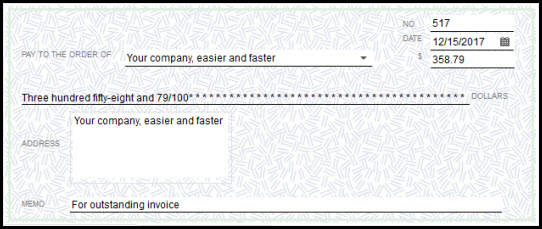

Recognize this?

Electronic checks payments can solve that problem. This technology allows you to accept paper checks payments, scan them using an approved scanning device (or type the identifying numbers in) and transfer the payment electronically through the Federal Reserve Bank’s ACH Network. The funds are then taken from your customer’s account and deposited in yours within a day or two.

Intuit Check Solution for QuickBooks

Using Intuit Check Solution for QuickBooks, your business will benefit in several ways, including:

How it works

If you don’t already have one, you’ll have to create a merchant account with Intuit and learn how to use the Merchant Service Center. Intuit Check payments Solution for QuickBooks is only available for QuickBooks 2010 and later, so if you’re using an older version, you’ll work exclusively with the Merchant Service Center. We can help you with this set of online tools.

To enable check-processing in QuickBooks, click Customers | Add Electronic Check Processing and follow the prompts.

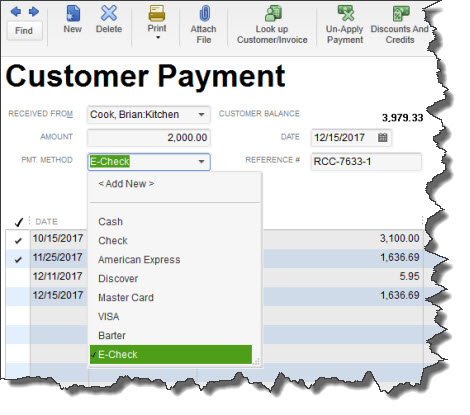

When you get a check that’s to pay an invoice, do what you normally do: Go to Customers | Receive Payments. As you complete the fields in this screen, just select E-Check as the payment method. Check the box at the bottom of the screen next to Process E-Check payment when saving, and save the payment record. Here, too, QuickBooks will lead you through the necessary steps.

If you’re applying a checks payment to an invoice, you’d use this screen. You can also apply an e-check to a sales receipt.

Of course, there are fees associated with accepting e-checks, just as there are with credit cards. But flexibility is the name of the game when it comes to customer remittances. Supporting a variety of payment options will not only accelerate your accounts receivable — it may actually help you make sales that you wouldn’t otherwise have made.