Q: Our company uses QuickBooks for real estate. Therefore, we must issue several 1099-S in QuickBooks forms at the end of the year. It would be helpful to do this through QB instead of on the typewriter!! 🙂

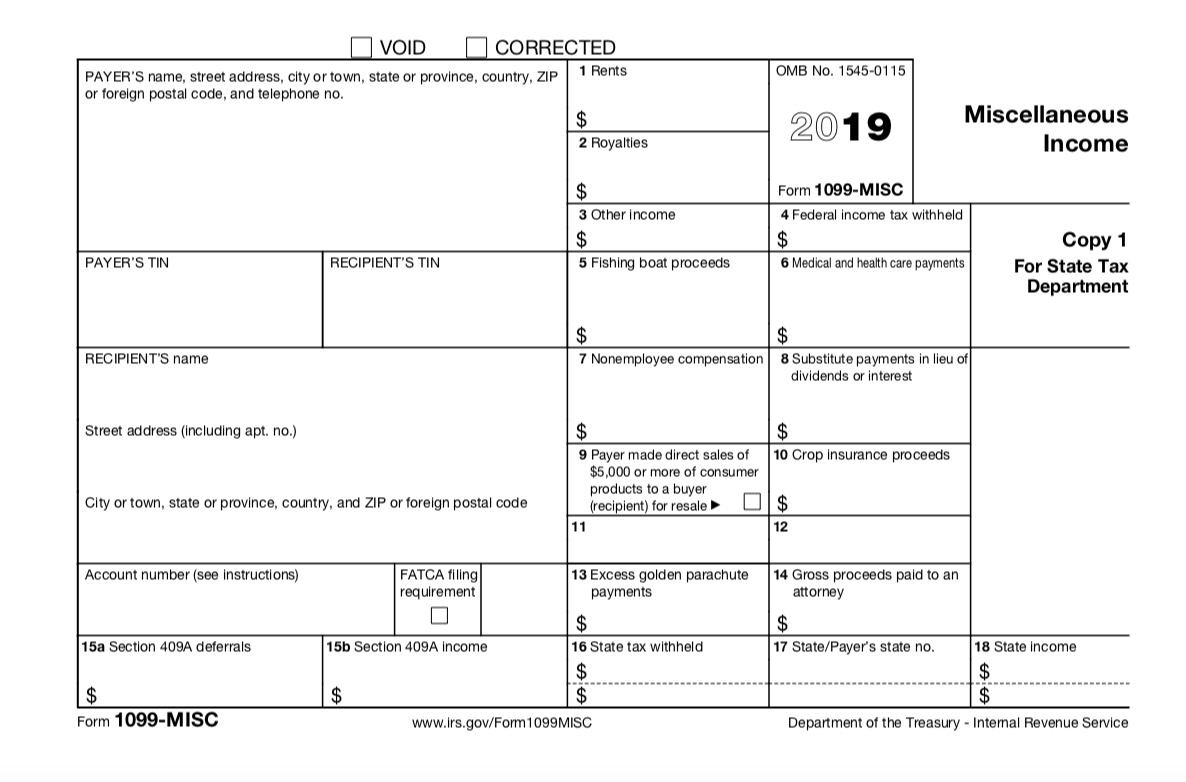

A: Fill out the 1099-S in QuickBooks form to record proceeds from real estate transactions.

Intuit Payroll online service offers an option for 1099. They charge Intuit 1099 E-File Service – For Small Business* Sign up now to E-File for just $25! File the 1099 and print them as well.

QuickBooks will print the 1099-MISC for you. For all other 1099 forms, check the IRS website. You can find the amounts in a QuickBooks report.