Much of a QuickBooks Consultant’s or a bookkeeper’s job lies in tracking the income and expenses of their clients, but that does not mean they should put their own financials on the back burner. CPAs, accountants, and bookkeepers offer several different services, including personal and business tax preparation, consulting, financial planning, bookkeeping, training services, and the list goes on. When you are already juggling the financials and charts of accounts of other people, it can be difficult to focus on your own… but luckily, someone (a.k.a. we) have created a chart of accounts for accounting and bookkeeping professionals.

We created a free PDF download of a chart of accounts tailored specifically for accountants, bookkeepers, and other accounting professionals; just complete the form below, and your shiny new chart of accounts will be promptly delivered to your inbox!

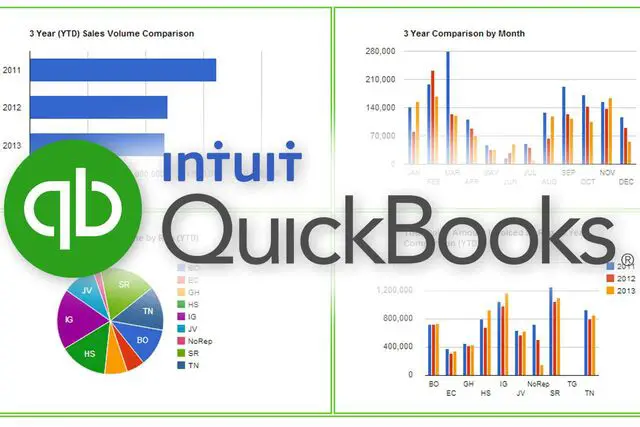

Most accounting companies are entirely service-based unless they sell apps, such as integrated QuickBooks add-on software. As a QuickBooks Solutions Provider and a group of accounting professionals, a lot of our accounts will look similar to yours. From our experience, here are some of the accounts that you might need to include:

The list looks like a lot, but don’t worry—setting up your income accounts depends on the kinds of services you provide. If you only provide one primary service, you may just have one “Accounting Services” income account. If you offer multiple services, perhaps tax preparation along with bookkeeping services, it is recommended that you create an income account for each one.

Luckily for you, we understand the nuances of the accounting and bookkeeping industry better than any other! Download your free chart of accounts so you can stop stressing and focus on the bigger picture.

What we do doesn’t stop there, though, and neither does your company’s accounting. The Fast Trac Consulting team provides a number of services to help you get your financial engine running better than ever!

You can schedule an appointment with one of our accounting experts to streamline your processes and get your business more efficient than ever before.