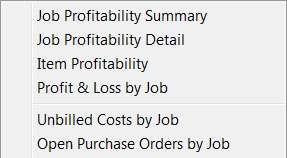

QuickBooks features six reports that help you determine which jobs are profitable and help you track unbilled costs and purchase orders.

The Job Profitability Summary report shows how much money was spent and earned for each Customer and each Job. The report also calculates the difference, or the profit of the Job. If you use QuickBooks for real estate and property management, use this report to determine profitability by tenant, property, and owner.

Select the Customer: Job for the Job Profitability Detail report. The report breaks down the items allocated to the job and shows the cost, revenue, and profitability of each job.

The Item Profitability report breaks down the cost, revenue and profitability by item. Determine which items are making money and which are not.

The Unbilled Costs by Job report lists the costs allocated to each Customer or Job that have not yet been billed as reimbursable expenses.

The Open Purchase Orders by Job report shows open purchase orders by each Customer and Job if you indicated which items were ordered for which client. You can track what products have not been received and which Jobs are waiting on the delivery.