Within QuickBooks, you can also manage your payroll and employee data for any business, including real estate and property management. Payroll is an important aspect of business management as it is heavily controlled by the government. You need to pay employee payroll taxes and keep good records.

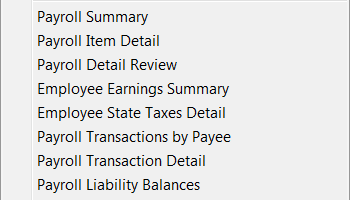

The Payroll Summary report shows the total wages, taxes with held, deductions from net pay, additions to net pay, and company-paid taxes as well as contributions.

The Payroll Item Detail report lists each payroll transaction by Payroll Item. It includes the date, employee, type of transaction and amount.

The Payroll Detail Review lists each day the payroll item was used and the total amount.

Employee Earnings Summary shows the breakdown of earnings by item including salary and each tax for a given period.

Employee State Taxes Detail lists details for state taxes including the payroll item, income subject to the tax, and the amount due.

Payroll Transaction by Payee lists all transactions by recipient of funds including employees and different tax agencies.

Payroll Transaction Detail shows all of the items per transaction. For example, it will break down all of the items for a specific paycheck.

Payroll Liability Balances tracks all payroll liabilities by item and by month. Track what you owe to whom at all times.