If you use QuickBooks to manage your real estate business, you may have wondered exactly how you should be recording the property. Many of our investors run into this problem, and there is an easy fix. Setting up accounts and associating your data with those accounts is vital for two reasons: 1) it saves you time, and 2) it keeps your financials running like a well-oiled machine. However, the “why” doesn’t explain the “how.”

One of our clients posed a similar question in regards to recording property value. Take a look at the answer we provided.

Q: Under which account do I record real estate’s value or the property’s loan balance?

A: A chart of accounts is essentially the backbone of your accounting system. That is why it is so important to set up your COA correctly. When you do so, you can enter property value and loans under the appropriate accounts and keep your finances organized.

Now, to answer your question about which account, there are some specifics:

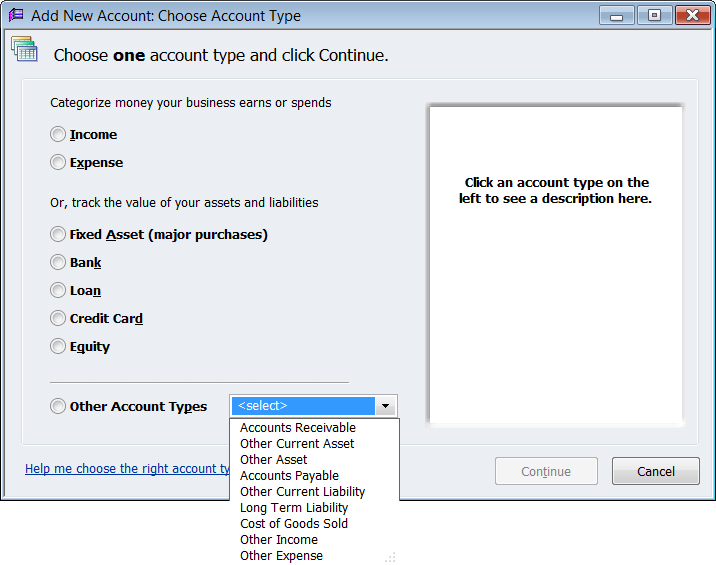

To set up your chart of accounts in QuickBooks and add one or more of these accounts as new, click Lists and then Chart of Accounts, and then hit CTRL + N.

A window like the one above should appear. From there, choose the appropriate account type and follow the steps to add it to your chart of accounts. Easy as pie!

For more information on setting up a proper QuickBooks chart of accounts for real estate, refer to our post QuickBooks Chart of Accounts for Landlord Rentals, Residential, and Multi-Unit Properties.