When using QuickBooks to manage the financials of your real estate business, items and accounts may be confusing. A client of ours recently asked this question about recording sales commission and we thought our response might be helpful. Read the information careful and let us know by leaving a comment if you have any additional questions.

.

Q: What is the correct way of recording a sale of a property for a real estate agency? (i.e. the commission earned). Quickbooks asks for an item code on the invoicing screen (i.e. Stock item), but the properties are not owned by the estate agency.

.

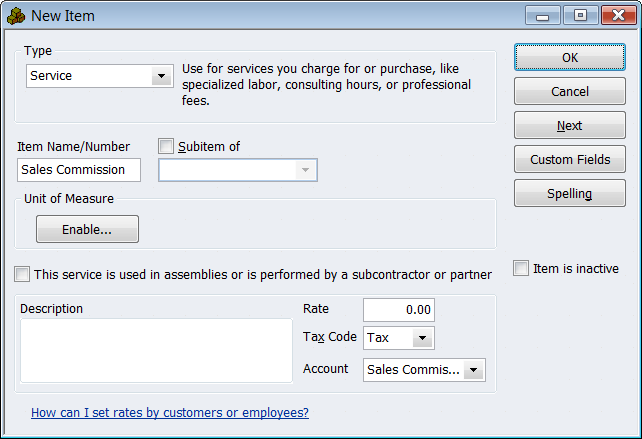

A: You can only use items on Invoices. For commission earned, create an item and link it to income account.

Then, you can enter a sales receipt to track the commission earned. Use Sales Commission as the item.