You’ve just made QuickBooks payments portable and more flexible, and you’ll probably increase sales and get paid faster

QuickBooks Payments Pro and Premier are remarkable applications. You can create records and transactions, manage sales and purchases, process your payroll, and run reports right from your desktop.

But today’s successful companies have moved beyond the desktop. Business is transacted at conferences and in coffee shops and airports, and it relies heavily on the Internet to do so.

That’s probably one of the reasons you decided to sign up for QuickBooks Payments: You need mobile access to your accounting data because you make sales away from the office. But you’re about to find out that your monthly fee can have an even greater impact on your company’s profits.

It’s the rare businessperson who doesn’t have opportunities to make sales away from the office or retail store. In the past, you might have accepted a check and penned a receipt on a piece of paper, which meant you had to record the payment once you returned. That also meant inconvenience, extra work, and a not-so-professional image.

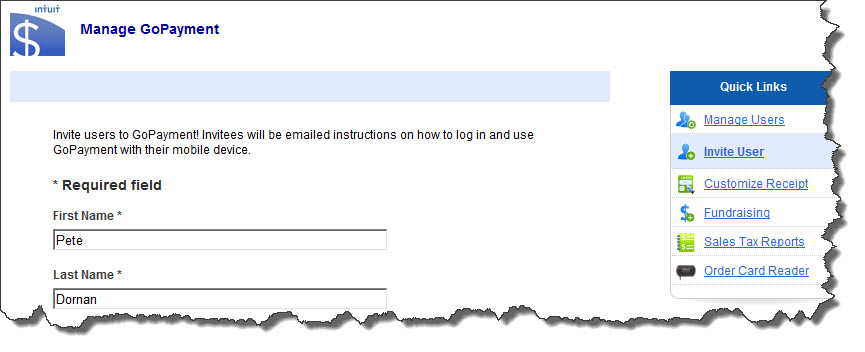

Intuit GoPayment solves those problems. You – and up to 49 other users — simply download the app on your iOS or Android mobile device. You can then record payments wherever you are. Either type in your customer’s bank card information or swipe the card using the free reader. Your customers can choose to have receipts texted or emailed to them.

You’ll be able to manage your GoPayment account in the Merchant Service Center.

IMPORTANT! GoPayment transactions do not automatically sync with QuickBooks; you’ll have to do this manually. We can help you learn how to do this.

Perhaps the biggest advantage to having a QuickBooks Payment account is the ability to accept credit card payments from within QuickBooks. Once you’ve been approved, you’ll need to make sure that QuickBooks is set up to support this activity. Go to Edit | Preferences and click on the Payments link, then Company Preferences.

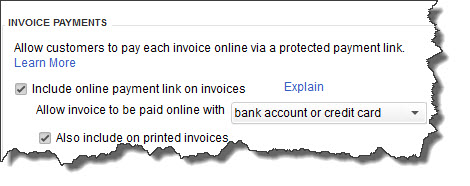

Be sure that the box in front of the Include online payment link on invoices is checked, and that all other preferences there are correct.

If you want your customers to be able to pay invoices with a credit card, you’ll need to make sure that you’ve established your preferences.

Your invoices will now include a link to a secure site where customers can make payments using credit cards. And unlike GoPayment, these funds move directly into QuickBooks for processing.

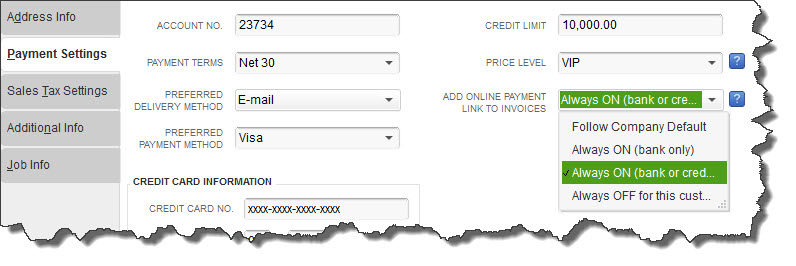

When you specified the above preference, you set up a company-wide default. This can be turned on or off for individual customers, as can other options. Open a customer record and click on Payment Settings to see this.

Saving your customers’ credit card numbers in Payment Settings will save you time later on. You can also indicate whether or not the online payment link should appear on specific customers’ invoices.

We talked about best practices for using QuickBooks Payments earlier this year, but a few of those bear repeating here:

You and your employees work hard for your money. Make sure that you’ve established a workflow that doesn’t let payments slip through the cracks.